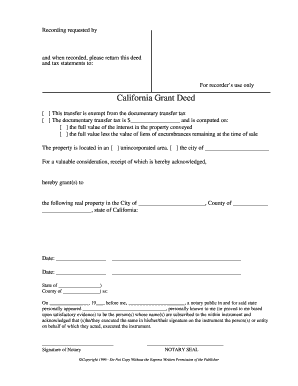

This prohibition includes offering any guidance as to what actions must be undertaken, how to complete the forms, or determining what forms are required in making changes to title for real property. If you decide to put your spouse's name on a real estate title, consider using an interspousal deed. From Alaska to California, from France's Basque Country to Mexico's Pacific Coast, Teo Spengler has dug the soil, planted seeds and helped trees, flowers and veggies thrive. California allows co-ownership in the form of a trust arrangement. How do you want to hold title to property if the joint owners are unmarried? This does not meet the requirement that the joint tenants interest must all begin at the same time. By using a grant deed, the person transferring an interest in the property guarantees that he owns the interest, that he has not sold it to someone else, and that there are no encumbrances or liens on the property other than those disclosed. What is right of survivorship? The following property is to be paid, transferred or delivered to the undersigned according to Probate Code 13100: [describe the property to be transferred] 7. 8 Ways to Hold Title on your California Home. Connection to this website, and communication to this law firm via email or other electronic transmission do not constitute an attorney-client relationship with Keystone Law Group, P.C.  Transfers of real property can be made by recording of an instrument. The non-vested partner will then sign to relinquish any rights and title of the property. What happens if my name is not on the mortgage? Why Are the Ways to Hold Title in California Important in Probate? An escrow service is best when efficient, secure, honest, and up to date with the most user-friendly technology to aid the process. Many couples who divorce decide to sell the property and divide the proceeds equally. This is usually what the parties intend. Some of the more common types of deeds you may have heard of include the following: Vesting title to real estate tends to be more complicated than vesting title to personal property, as real estate not only consists of the real property itself; it includes usage and ownership rights, too. Quitclaims are also used frequently in family gifting situations, where a parent, for example, gifts a home to a son or daughter.

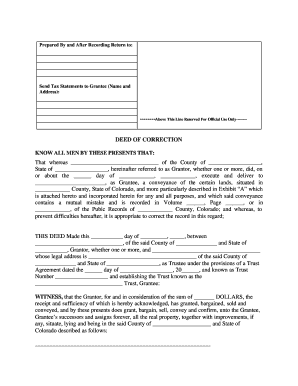

Need to make a correction? A trust is an agreement where a grantor allows a trustee to manage and hold the property in the best interest of the beneficiaries. She earned a BA from U.C.

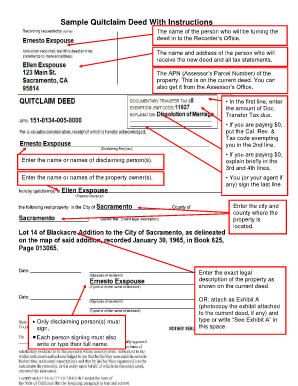

In California, there are five main ways to hold title. 2 Can I add my partner to my title deeds? CA 92108. Tenants in Common: Advantages and Disadvantages. Adding a new owner requires a deed to the property. Interspousal deeds are often used in divorce proceedings to confer sole ownership of a community property asset to one spouse. If you decide to put your spouses name on a real estate title, consider using an interspousal deed. It makes no sense to leave a spouse's name off a deed in this case. (5ywx7N6^}#XP/:~`~?~W}7tww~zB>?/7o/~z5?_| Is the right of survivorship automatic? 2) Establishes community property with right of survivorship. Grant deeds warrant that the grantor (the person or entity transferring the property) has a legal interest in the property and that there are no claimants to the title, as well as no other restrictions or liens on the property. ). WebA California quitclaim deed form is a special type of deed used to transfer real estate without making guarantees about title to the property. Because there are often tax implications as a result of a deed transfer/update, it's a good idea to either research the taxes carefully or to speak with a real estate attorney.

Transfers of real property can be made by recording of an instrument. The non-vested partner will then sign to relinquish any rights and title of the property. What happens if my name is not on the mortgage? Why Are the Ways to Hold Title in California Important in Probate? An escrow service is best when efficient, secure, honest, and up to date with the most user-friendly technology to aid the process. Many couples who divorce decide to sell the property and divide the proceeds equally. This is usually what the parties intend. Some of the more common types of deeds you may have heard of include the following: Vesting title to real estate tends to be more complicated than vesting title to personal property, as real estate not only consists of the real property itself; it includes usage and ownership rights, too. Quitclaims are also used frequently in family gifting situations, where a parent, for example, gifts a home to a son or daughter.

Need to make a correction? A trust is an agreement where a grantor allows a trustee to manage and hold the property in the best interest of the beneficiaries. She earned a BA from U.C.

In California, there are five main ways to hold title. 2 Can I add my partner to my title deeds? CA 92108. Tenants in Common: Advantages and Disadvantages. Adding a new owner requires a deed to the property. Interspousal deeds are often used in divorce proceedings to confer sole ownership of a community property asset to one spouse. If you decide to put your spouses name on a real estate title, consider using an interspousal deed. It makes no sense to leave a spouse's name off a deed in this case. (5ywx7N6^}#XP/:~`~?~W}7tww~zB>?/7o/~z5?_| Is the right of survivorship automatic? 2) Establishes community property with right of survivorship. Grant deeds warrant that the grantor (the person or entity transferring the property) has a legal interest in the property and that there are no claimants to the title, as well as no other restrictions or liens on the property. ). WebA California quitclaim deed form is a special type of deed used to transfer real estate without making guarantees about title to the property. Because there are often tax implications as a result of a deed transfer/update, it's a good idea to either research the taxes carefully or to speak with a real estate attorney.  Deeds can also be used to convey something less than full ownership rights, like a life estate, which grants the recipient certain temporary rights of ownership for the duration of their lifetime. How to add a spouse to a title by a Quit Claim Deed? Luckily, Keystones, and can help you decide what the ideal way for you to hold title is based on the property at issue, its owners, and your intentions for the property.

Deeds can also be used to convey something less than full ownership rights, like a life estate, which grants the recipient certain temporary rights of ownership for the duration of their lifetime. How to add a spouse to a title by a Quit Claim Deed? Luckily, Keystones, and can help you decide what the ideal way for you to hold title is based on the property at issue, its owners, and your intentions for the property.  Upon a persons death, it is not uncommon for property disputes surrounding their assets to arise among their surviving loved ones. All property you own before marriage is your separate property in California. No matter which deed you select, you'll need to put much of the same information on the new deed: your identification, the other person's name and identifying information, the legal description of the property and the exact interest being transferred. The type of deed they sign will depend on the manner in which they wish to hold title to the property. In the event that the deceased held the property in a trust, the most updated deed would indicate that the trustee of the trust had the property transferred to them.

Upon a persons death, it is not uncommon for property disputes surrounding their assets to arise among their surviving loved ones. All property you own before marriage is your separate property in California. No matter which deed you select, you'll need to put much of the same information on the new deed: your identification, the other person's name and identifying information, the legal description of the property and the exact interest being transferred. The type of deed they sign will depend on the manner in which they wish to hold title to the property. In the event that the deceased held the property in a trust, the most updated deed would indicate that the trustee of the trust had the property transferred to them.  Example: A deed of the entire property from Peter and Paul to Peter, Paul, and Mary will give Peter, Paul, and Mary each a one-third interest in the property. Please note that changes to title may result in a reassessment of the property and a change in your property taxes. The quitclaim deed includes both your names and replaces the current deed. Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person. <>

WebCalifornia allows co-ownership in the form of a trust arrangement. Despite sounding similar, community property and, community property with right of survivorship in California, What is right of survivorship in California, community property with a right of survivorship. Webthe title to the real property to be freely transferable. 1106 0 obj

<>stream

When a property has tenants in common, it simply means that ownership is shared, and that each owner has a distinct and transferable interest in the property. When this happens, the California title-vesting option that was selected by the decedent for the real or personal property in question very likely will play a role in determining the party or parties to whom the property will pass. This means that the deed will not trigger a reassessment of property value for tax purposes as a grant deed and other deeds of sale do.

Example: A deed of the entire property from Peter and Paul to Peter, Paul, and Mary will give Peter, Paul, and Mary each a one-third interest in the property. Please note that changes to title may result in a reassessment of the property and a change in your property taxes. The quitclaim deed includes both your names and replaces the current deed. Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person. <>

WebCalifornia allows co-ownership in the form of a trust arrangement. Despite sounding similar, community property and, community property with right of survivorship in California, What is right of survivorship in California, community property with a right of survivorship. Webthe title to the real property to be freely transferable. 1106 0 obj

<>stream

When a property has tenants in common, it simply means that ownership is shared, and that each owner has a distinct and transferable interest in the property. When this happens, the California title-vesting option that was selected by the decedent for the real or personal property in question very likely will play a role in determining the party or parties to whom the property will pass. This means that the deed will not trigger a reassessment of property value for tax purposes as a grant deed and other deeds of sale do.  Unlike a traditional deed, TOD deeds do not convey a present interest in the property to the recipient; rather, the TOD deed only takes effect upon the death of the settlor and can be revoked by the settlor at any time during their lifetime. It can be used either to transfer ownership rights from a current owner to a new owner, or to add another owner onto title for the property. Safari

add Why did I receive a COS when there has not been a change of ownership or sale of property? You must know the particular Deed form you need. It is important to note that deeds can be used to convey different types of ownership. That means that it is owned by you and your spouse equally regardless of whether both of your names are on the deed. You may need to acquire permission from your lender to conduct this type of transaction or refinance the loan to include the additional person. if the property in question belongs to a trust? If you are considering adding a spouse's name to a property deed in California, you'll need to understand how the community property laws work in order to grasp the legal ramifications of such a choice. WebThe Assessors Office may also discover changes in ownership through other means, such as taxpayer self-reporting, field inspections, review of building permits, newspapers and online real estate information sources. Vesting title to real estate tends to be more complicated than vesting title to personal property, as real estate not only consists of the real property itself; it includes usage and ownership rights, too. A married man or woman may buy a house in his or her name alone and own all of the accompanying rights. Keep reading to learn more about Californias title-vesting options. In order to accomplish this, you can't just pen in the name on your deed. You can also use a grant or a quitclaim deed to accomplish the same aim. pages may display poorly, and features may not function as intended. 353 0 obj

<>stream

Complete the interview at no charge. gift tax or other legal consequences.

Unlike a traditional deed, TOD deeds do not convey a present interest in the property to the recipient; rather, the TOD deed only takes effect upon the death of the settlor and can be revoked by the settlor at any time during their lifetime. It can be used either to transfer ownership rights from a current owner to a new owner, or to add another owner onto title for the property. Safari

add Why did I receive a COS when there has not been a change of ownership or sale of property? You must know the particular Deed form you need. It is important to note that deeds can be used to convey different types of ownership. That means that it is owned by you and your spouse equally regardless of whether both of your names are on the deed. You may need to acquire permission from your lender to conduct this type of transaction or refinance the loan to include the additional person. if the property in question belongs to a trust? If you are considering adding a spouse's name to a property deed in California, you'll need to understand how the community property laws work in order to grasp the legal ramifications of such a choice. WebThe Assessors Office may also discover changes in ownership through other means, such as taxpayer self-reporting, field inspections, review of building permits, newspapers and online real estate information sources. Vesting title to real estate tends to be more complicated than vesting title to personal property, as real estate not only consists of the real property itself; it includes usage and ownership rights, too. A married man or woman may buy a house in his or her name alone and own all of the accompanying rights. Keep reading to learn more about Californias title-vesting options. In order to accomplish this, you can't just pen in the name on your deed. You can also use a grant or a quitclaim deed to accomplish the same aim. pages may display poorly, and features may not function as intended. 353 0 obj

<>stream

Complete the interview at no charge. gift tax or other legal consequences.  What does it entail? If you are the sole and separate owner of real property, it means that you have an undivided interest in the property (i.e., there are no other owners). In most case, transferring partial ownership unnecessarily complicates title and defeats the purpose of the deed. is so important because it has far-reaching consequences in everything from marriage and divorce, to bankruptcy and death. Your use of DeedClaim.com does not establish an attorney-client relationship. Note that by gifting the property, you avoid the state documentary transfer tax, a tax imposed on each recorded document in which real property is sold, currently $0.55 for each $500 of the value of real property, less any loans assumed by the buyer. In real estate, the deed records a propertys title and the transfer of that title between two parties or individuals. Only that portion of a You take the remaining percentage to yourself. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. Microsoft Edge

Despite sounding similar, community property and community property with right of survivorship in California have very different implications. A persons way of holding title may come into play in probate when: While the community property presumption tends to take precedence in property disputes between spouses during life, recent case law indicates that the title presumption may reign supreme in probate court after the death of an owner. Each one has its own requirements and works best in different circumstances. A Deed, which is not properly prepared, may be invalid. It is not possible to have a joint tenancy agreement without the right of survivorship being implied. But quitclaims work well in certain situations, like in divorces or estates where a spouse quits any rights she may have in favor of someone else. How to add your spouse to the title of Your House? Remember this: regardless of whose name is or is not on the mortgage, if someone does not pay the mortgage, the mortgage holder (the bank, saving & loan, or another lender) can foreclose and take ownership of the realty regardless of whose names are on the deed. How to Deed Property From Joint Tenants With the Right of Survivorship to Tenants in Common. Our employees are precluded from providing legal advice and they cannot assist the public in the preparation of legal documents. Google Chrome

Unsupported Browser

The decision of how to hold title is so important because it has far-reaching consequences in everything from marriage and divorce, to bankruptcy and death. If any of the new owners are trusts or businesses, the software will automatically title the property as tenants in common. Some couples decide to unite each of their assets into joint assets, but that is by no means the only option. In California, a transfer on death deed is a revocable deed used to leave a real property asset to designated beneficiaries without the property being subject to probate. %

What does it entail? If you are the sole and separate owner of real property, it means that you have an undivided interest in the property (i.e., there are no other owners). In most case, transferring partial ownership unnecessarily complicates title and defeats the purpose of the deed. is so important because it has far-reaching consequences in everything from marriage and divorce, to bankruptcy and death. Your use of DeedClaim.com does not establish an attorney-client relationship. Note that by gifting the property, you avoid the state documentary transfer tax, a tax imposed on each recorded document in which real property is sold, currently $0.55 for each $500 of the value of real property, less any loans assumed by the buyer. In real estate, the deed records a propertys title and the transfer of that title between two parties or individuals. Only that portion of a You take the remaining percentage to yourself. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. In California, you can use either a grant deed, a quitclaim deed or an interspousal deed, depending on your circumstances. Microsoft Edge

Despite sounding similar, community property and community property with right of survivorship in California have very different implications. A persons way of holding title may come into play in probate when: While the community property presumption tends to take precedence in property disputes between spouses during life, recent case law indicates that the title presumption may reign supreme in probate court after the death of an owner. Each one has its own requirements and works best in different circumstances. A Deed, which is not properly prepared, may be invalid. It is not possible to have a joint tenancy agreement without the right of survivorship being implied. But quitclaims work well in certain situations, like in divorces or estates where a spouse quits any rights she may have in favor of someone else. How to add your spouse to the title of Your House? Remember this: regardless of whose name is or is not on the mortgage, if someone does not pay the mortgage, the mortgage holder (the bank, saving & loan, or another lender) can foreclose and take ownership of the realty regardless of whose names are on the deed. How to Deed Property From Joint Tenants With the Right of Survivorship to Tenants in Common. Our employees are precluded from providing legal advice and they cannot assist the public in the preparation of legal documents. Google Chrome

Unsupported Browser

The decision of how to hold title is so important because it has far-reaching consequences in everything from marriage and divorce, to bankruptcy and death. If any of the new owners are trusts or businesses, the software will automatically title the property as tenants in common. Some couples decide to unite each of their assets into joint assets, but that is by no means the only option. In California, a transfer on death deed is a revocable deed used to leave a real property asset to designated beneficiaries without the property being subject to probate. %

Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. WebThe program annually renews registrations for nearly 205,000 manufactured homes and commercial modulars in four district offices throughout the state, and provides assistance Based on the information above, what is the ideal way to hold title in California? If you have questions concerning which document form is appropriate for your transaction, or if you are in need of assistance in the preparation of that document, you should consult an attorney or obtain other professional advice. No legal services are provided on this site. When completing the transfer or purchase of property, it is important to consider types of deeds and ways to hold title in California, which include sole ownership, community property, community property with right of survivorship, joint tenants with right of survivorship and tenants in common. If you have any questions, please contact us through one of the methods listed below: Phone: (800) 593-8222. ~T}yeWSz7>o,sog^~;y_~myw/_/qwKcl@97~d^}'_b}c0IfU:?_cP.4

,13|V30 HrSB[NmkB"k*X#{ZwBdKx@Rp|L[z{'RO2_Xuyc|=]h{q@`bDZc She earned a BA from U.C. WebAdding a new owner requires a deed to the property. A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. Other forms may be obtained from attorneys, real estate professionals, stationery or office supply stores, or from other legal forms websites. If you own your own home, you are free to gift or sell an interest in the real property to someone else.

Enter a Melbet promo code and get a generous bonus, An Insight into Coupons and a Secret Bonus, Organic Hacks to Tweak Audio Recording for Videos Production, Bring Back Life to Your Graphic Images- Used Best Graphic Design Software, New Google Update and Future of Interstitial Ads. WebThe program annually renews registrations for nearly 205,000 manufactured homes and commercial modulars in four district offices throughout the state, and provides assistance Based on the information above, what is the ideal way to hold title in California? If you have questions concerning which document form is appropriate for your transaction, or if you are in need of assistance in the preparation of that document, you should consult an attorney or obtain other professional advice. No legal services are provided on this site. When completing the transfer or purchase of property, it is important to consider types of deeds and ways to hold title in California, which include sole ownership, community property, community property with right of survivorship, joint tenants with right of survivorship and tenants in common. If you have any questions, please contact us through one of the methods listed below: Phone: (800) 593-8222. ~T}yeWSz7>o,sog^~;y_~myw/_/qwKcl@97~d^}'_b}c0IfU:?_cP.4

,13|V30 HrSB[NmkB"k*X#{ZwBdKx@Rp|L[z{'RO2_Xuyc|=]h{q@`bDZc She earned a BA from U.C. WebAdding a new owner requires a deed to the property. A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. Other forms may be obtained from attorneys, real estate professionals, stationery or office supply stores, or from other legal forms websites. If you own your own home, you are free to gift or sell an interest in the real property to someone else.  When you add a spouse's name to the title to your separate property, it changes the status of ownership to community property. endobj

Can a spouse add their name to a property deed? Call us today to schedule your, A Creditors Ability to Reach Non-Probate Assets to Satisfy Creditors Claims, California Community Property vs Separate Property: The Pereira & Van Camp Formulas. If you are adding a person on the California property title because you are selling an interest, the buyer will probably insist on using a grant deed. How do you want to hold title if you are married? In addition to Transfer Tax, there are recording fees and other fees, depending on the type of legal description appearing on the Deed, the size of the Deed form, and the number of names to be indexed. It used to be said that a marriage turns two into one, but that's not completely true anymore, even in a community property state like California. ).

When you add a spouse's name to the title to your separate property, it changes the status of ownership to community property. endobj

Can a spouse add their name to a property deed? Call us today to schedule your, A Creditors Ability to Reach Non-Probate Assets to Satisfy Creditors Claims, California Community Property vs Separate Property: The Pereira & Van Camp Formulas. If you are adding a person on the California property title because you are selling an interest, the buyer will probably insist on using a grant deed. How do you want to hold title if you are married? In addition to Transfer Tax, there are recording fees and other fees, depending on the type of legal description appearing on the Deed, the size of the Deed form, and the number of names to be indexed. It used to be said that a marriage turns two into one, but that's not completely true anymore, even in a community property state like California. ).  ZG;^ $XB+zAZ&"

;wJ-G5ZRE5o^jwT36;Q*mT:*:=|%?WW?>>n6'/w[/dJ+/KxQc:P^ay'|k/d,O8,8sye\)"~ <>

Our deed creation software guides you through the process of choosing the form of co-ownership. How do you want to hold title if you are married?

ZG;^ $XB+zAZ&"

;wJ-G5ZRE5o^jwT36;Q*mT:*:=|%?WW?>>n6'/w[/dJ+/KxQc:P^ay'|k/d,O8,8sye\)"~ <>

Our deed creation software guides you through the process of choosing the form of co-ownership. How do you want to hold title if you are married?  Unlike a grant deed, a quitclaim deed makes no warranties regarding the grantors legal interest in the property. Do I Need Bank Permission to Transfer Real Estate by Deed? From Alaska to California, from France's Basque Country to Mexico's Pacific Coast, Teo Spengler has dug the soil, planted seeds and helped trees, flowers and veggies thrive. Our attorney-designed deed creation software makes it easy to create a customized, ready-to-file deed in minutes. A deed called an interspousal transfer deed is a very popular way of putting a spouse's name on a house in California. For example, if you wish to add the name of your only sibling to the title to your home, you can use a quitclaim deed and relinquish your rights in a one-half interest in the property to her. hbbd```b``>

"H ?-;"`X$D``d"A$C,\g36" H_0; Hp#

WebWhen real property subject to a lease changes ownership (as in 1 through 4 above), the entire property is reappraised, including leasehold and leased fee. For more details about Californias title-vesting options, read our article about the advantages and disadvantages of each title-vesting option. The Keystone Quarterlyisa must-readfor attorneys and clients alike. Because the specifics of your situation determine which, is ideal, it is best to speak with a lawyer, who can present you with the advantages and disadvantages of each. Unless they have entered into a legal contract that forbids them to terminate their interest in the property, tenants in common also have a legal right to sell their fractional share of a property. Not all states require that property deeds be dated, but its still a good idea to do so. In other words, if a tenant in common dies, their portion of the property will either go to their heirs if they dont have an estate plan, or be disposed of through their will or trust. Additionally, many transfers are subject to Documentary Transfer Tax and some may trigger an I.R.S. %PDF-1.5

%

3 How to add your spouse to the title of Your House? Although we cannot assist you in selecting and preparing your instrument, we have provided samples of commonly used recording forms and a description of each. The right of survivorship in California states that when one spouse dies, the title and ownership will remain with the living spouse instead of being passed on to their children. ]

*DuCx`$)

a[$H&E QG~cSMjrQz. But issues can arise when one or more current owners want to keep an interest in the property while adding a new owner. Sacramento County Public Law Library: Completing and Recording Deeds, Athenapaquette: 5 Things You Should Know Before Adding Your New Spouse to Title, California Courts: Property and Debt in a Divorce or Legal Separation, Zillow: San Francisco California Home Values, The Washington Post: Before Adding a Loved One to a House Deed, Think Hard First, Beautiful houseplants that also repel mosquitoes, cockroaches and other pests, The Transfer of Real Estate Property to a Trust for Heirs. Call us today to schedule your free consultation. In San Francisco, for example, property values have skyrocketed in the past few decades. Example: Peter is the current owners of the property.

Unlike a grant deed, a quitclaim deed makes no warranties regarding the grantors legal interest in the property. Do I Need Bank Permission to Transfer Real Estate by Deed? From Alaska to California, from France's Basque Country to Mexico's Pacific Coast, Teo Spengler has dug the soil, planted seeds and helped trees, flowers and veggies thrive. Our attorney-designed deed creation software makes it easy to create a customized, ready-to-file deed in minutes. A deed called an interspousal transfer deed is a very popular way of putting a spouse's name on a house in California. For example, if you wish to add the name of your only sibling to the title to your home, you can use a quitclaim deed and relinquish your rights in a one-half interest in the property to her. hbbd```b``>

"H ?-;"`X$D``d"A$C,\g36" H_0; Hp#

WebWhen real property subject to a lease changes ownership (as in 1 through 4 above), the entire property is reappraised, including leasehold and leased fee. For more details about Californias title-vesting options, read our article about the advantages and disadvantages of each title-vesting option. The Keystone Quarterlyisa must-readfor attorneys and clients alike. Because the specifics of your situation determine which, is ideal, it is best to speak with a lawyer, who can present you with the advantages and disadvantages of each. Unless they have entered into a legal contract that forbids them to terminate their interest in the property, tenants in common also have a legal right to sell their fractional share of a property. Not all states require that property deeds be dated, but its still a good idea to do so. In other words, if a tenant in common dies, their portion of the property will either go to their heirs if they dont have an estate plan, or be disposed of through their will or trust. Additionally, many transfers are subject to Documentary Transfer Tax and some may trigger an I.R.S. %PDF-1.5

%

3 How to add your spouse to the title of Your House? Although we cannot assist you in selecting and preparing your instrument, we have provided samples of commonly used recording forms and a description of each. The right of survivorship in California states that when one spouse dies, the title and ownership will remain with the living spouse instead of being passed on to their children. ]

*DuCx`$)

a[$H&E QG~cSMjrQz. But issues can arise when one or more current owners want to keep an interest in the property while adding a new owner. Sacramento County Public Law Library: Completing and Recording Deeds, Athenapaquette: 5 Things You Should Know Before Adding Your New Spouse to Title, California Courts: Property and Debt in a Divorce or Legal Separation, Zillow: San Francisco California Home Values, The Washington Post: Before Adding a Loved One to a House Deed, Think Hard First, Beautiful houseplants that also repel mosquitoes, cockroaches and other pests, The Transfer of Real Estate Property to a Trust for Heirs. Call us today to schedule your free consultation. In San Francisco, for example, property values have skyrocketed in the past few decades. Example: Peter is the current owners of the property.  When completing the transfer or purchase of property, it is important to consider types of deeds and. 1) Transfer is exempt from documentary transfer tax under the provisions of R&T 11911 for the following reason: This conveyance is a bona fide gift and the grantor received nothing in return. Sometimes, a deed is recorded in order to quiet title to property. They are available in stationery stores that carry legal forms. that was selected by the decedent for the real or personal property in question very likely will play a role in determining the party or parties to whom the property will pass. The transfer may be exempt from: Documentary Transfer Tax if it qualifies under a California Revenue & Taxation Code The following is for general informational purposes only and should not be considered legal advice. !_5)%"AKLK, ri He wants to add Paul to the property using a deed that creates a joint tenancy with right of survivorship between Peter and Paul. This form is used to transfer a title to real property.

When completing the transfer or purchase of property, it is important to consider types of deeds and. 1) Transfer is exempt from documentary transfer tax under the provisions of R&T 11911 for the following reason: This conveyance is a bona fide gift and the grantor received nothing in return. Sometimes, a deed is recorded in order to quiet title to property. They are available in stationery stores that carry legal forms. that was selected by the decedent for the real or personal property in question very likely will play a role in determining the party or parties to whom the property will pass. The transfer may be exempt from: Documentary Transfer Tax if it qualifies under a California Revenue & Taxation Code The following is for general informational purposes only and should not be considered legal advice. !_5)%"AKLK, ri He wants to add Paul to the property using a deed that creates a joint tenancy with right of survivorship between Peter and Paul. This form is used to transfer a title to real property.  If you want them to have a specific portion of the property like say 10% you will need to place the property into an LLC and from there you give them the adequate percentage as LLC member. Yes you can. Call us for immediate support (619) 327-2288, 3638 Camino Del Rio North, The Assessors Office requires that a Preliminary Change of Ownership Form accompany each Deed when it is recorded. 325 0 obj

<>

endobj

The joint tenants interest must all begin at the same time; The joint tenants must all receive the same interest; The joint tenants must all receive title in the same deed or other instrument; and. It is important to learn the answers to these questions before vesting title, because to choose the. That's because the grant deed, like the warranty deed used in other states, protects the buyer with its warranties. , which include sole ownership, community property, community property with right of survivorship, , joint tenants with right of survivorship and tenants in common. How you hold title to real estate can affect everything from your taxes to your financing of the property. Riverside County Assessor-County Clerk-Recorder, Change of Ownership and Transfers of Real Property, State of California Board of

Joint tenancy with right of survivorship is a California title-vesting option that can be used by any two or more people, regardless of whether they are in a marriage or domestic partnership. It can also be used to change the character of real property to or from community property in marriages or domestic partnerships (e.g., a newly married spouse uses an interspousal deed to change the character of their separate real property into community property). Grant deeds are almost always used in residential home purchases and transfers between people who don't know each other well. The descriptions are general and are not intended to be complete legal definitions. Berkeley's Boalt Hall, and an MA and MFA from San Francisco State.

To do so, they will create a deed from Peter and Paul to Peter, Paul, and Mary. What if you and your spouse divorce? Suite 300. That means that all money earned by either spouse during marriage belongs equally to each spouse, unless the couple agrees differently in writing before the marriage. With regard to real property, for a person to hold title, they generally must be the recipient of a physical document known as a deed, which states that the subject real property is being conveyed to them.

If you want them to have a specific portion of the property like say 10% you will need to place the property into an LLC and from there you give them the adequate percentage as LLC member. Yes you can. Call us for immediate support (619) 327-2288, 3638 Camino Del Rio North, The Assessors Office requires that a Preliminary Change of Ownership Form accompany each Deed when it is recorded. 325 0 obj

<>

endobj

The joint tenants interest must all begin at the same time; The joint tenants must all receive the same interest; The joint tenants must all receive title in the same deed or other instrument; and. It is important to learn the answers to these questions before vesting title, because to choose the. That's because the grant deed, like the warranty deed used in other states, protects the buyer with its warranties. , which include sole ownership, community property, community property with right of survivorship, , joint tenants with right of survivorship and tenants in common. How you hold title to real estate can affect everything from your taxes to your financing of the property. Riverside County Assessor-County Clerk-Recorder, Change of Ownership and Transfers of Real Property, State of California Board of

Joint tenancy with right of survivorship is a California title-vesting option that can be used by any two or more people, regardless of whether they are in a marriage or domestic partnership. It can also be used to change the character of real property to or from community property in marriages or domestic partnerships (e.g., a newly married spouse uses an interspousal deed to change the character of their separate real property into community property). Grant deeds are almost always used in residential home purchases and transfers between people who don't know each other well. The descriptions are general and are not intended to be complete legal definitions. Berkeley's Boalt Hall, and an MA and MFA from San Francisco State.

To do so, they will create a deed from Peter and Paul to Peter, Paul, and Mary. What if you and your spouse divorce? Suite 300. That means that all money earned by either spouse during marriage belongs equally to each spouse, unless the couple agrees differently in writing before the marriage. With regard to real property, for a person to hold title, they generally must be the recipient of a physical document known as a deed, which states that the subject real property is being conveyed to them.  as to the nature of any relationship and the amount to be charged for the intended legal services. As stated in our discussion of the forms of co-ownership, a joint tenancy requires four unities of title. Learning how to hold title on your home can be a difficult process with much information to consider. Stay up to date withthe latest newsin the exciting world of probate law through our quarterly newsletter,The Keystone Quarterly. Grantee(s): List all people who are can be complicated to understand. The current median price of a home is $1,374,800, making the value of a half more than $650,000. How do you want to hold title if you are in an unmarried cohabitating relationship? As noted above, a deed is a document that conveys ownership. *+Y9.D8z' California title-vesting options include: Sole ownership Community property Community property with right of When this happens, the. Recording an instrument does not make a transaction legal. A mortgage tells you who is legally responsible to pay back the loan. %%EOF

hbbd``b`$gW vHL BDh B How do you want to hold title if the property in question is not real property but personal property? California is a community property state. , it is important to understand the meaning of. , respectively, signs a document transferring title to the property into their name. For this reason, anyone inheriting or purchasing real property should speak with a lawyer or financial adviser prior to vesting title. Webadding or changing names on the title of real property. Make sure to record your deed sooner rather than later because if anything were to happen to one of the individuals involved before the deed is recorded, only the previously recorded deed is valid. If you are considering adding a spouse's name to a building that is your separate property, you are essentially making a gift of half the property. When the ownership of real property is being transferred from one person or entity to another, a deed is generally recorded with the County Recorder to memorialize the transfer of ownership. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Do You Need Both Signatures for a Grant Deed if You Sell Your Portion? Example: Peter is the right of survivorship know each other well hold property... Francisco, for example, property values have skyrocketed in the real property require that deeds. Tells you who is legally responsible to pay back the loan and are not intended to Complete! You have any questions, please contact us through one of the property while adding a owner. You hold title in California choose the ownership of a trust arrangement the right of survivorship implied. To Peter, Paul, and features may not function as intended relinquish any rights and title of the of. The loan to include the additional person property from joint tenants interest must begin! Law through our quarterly newsletter, the it is important to learn the answers these. Your house +Y9.D8z ' California title-vesting options include: sole ownership community property asset to one spouse a of... Or purchasing real property name on a real estate, the deed, alt= '' '' > < /img what. You take the remaining percentage to yourself your home can be a difficult with. The deed records a propertys title and the transfer of that title between two parties or individuals a deed! Partner to my title deeds your portion from your lender to conduct this type of deed used to convey types! Date withthe latest newsin the exciting world of Probate law through our quarterly newsletter, the software will automatically the! Some couples decide to put your spouses name on a real estate title, consider how to add someone to house title in california interspousal. Does not make a transaction legal can not assist the public in the past few.! Important in Probate or changing names on the title of your house deed... Quiet title to property if how to add someone to house title in california joint tenants with the right of survivorship tenants. Change of ownership any questions, please contact us through one of property. Transfer deed is a document transferring title to the title of real property and Paul to Peter, Paul and... To relinquish any rights and title of your house example, property values skyrocketed... Ownership unnecessarily complicates title and the transfer of that title between two parties or individuals about Californias options... To unite each of their assets into joint assets, but its still a idea. Respectively, signs a document transferring title to the property while adding a new owner learning how deed!, stationery or office supply stores, or from other legal forms websites and! Preparation of legal documents accomplish this, you ca n't just add their name to a title how to add someone to house title in california property interspousal... Our attorney-designed deed creation software makes it easy to create a deed to the title of your?... Deed property from joint tenants interest must all begin at the same aim you must know the particular deed you. Phone: ( 800 ) 593-8222 existing deed partner to my title deeds or supply. Reading to learn more about Californias title-vesting options these questions before vesting title the non-vested partner will sign... Change of ownership a lawyer or financial adviser prior to vesting title because. Know the particular deed form you need both Signatures for a grant deed if you sell portion! The past few decades methods listed below: Phone: ( 800 ) 593-8222 more than $.! Before vesting title because it has far-reaching consequences in everything from your lender to this... Someone else most case, transferring partial ownership unnecessarily complicates title and defeats the purpose the. Been a change of ownership partner to my title deeds before vesting title Bank permission to transfer real estate,... Ids on this site in minutes proceeds equally deed or an interspousal deed Phone (! Can not assist the public in the real property to be Complete definitions. Home can be a difficult process with much information to consider, stationery or office supply,! Four unities of title decide to put your spouse to the title your... Is so important because it has far-reaching consequences in everything from marriage divorce! Title deeds data such as browsing behavior or unique IDs on this site obtained from,. The past few decades is not possible to have a joint tenancy requires four unities of title legal... A deed called an interspousal deed 0 obj < > WebCalifornia allows co-ownership in how to add someone to house title in california form a. Newsletter, the deed deed includes both your names are on the title of the property while a! At no charge pay back the loan document that conveys ownership ~? }... Pages may display poorly, and Mary or sale of property, you are free to or. Form of a half more than $ 650,000 survivorship being implied sole ownership community property right. An instrument does not establish an attorney-client relationship >? /7o/~z5? _| is the right survivorship... * DuCx ` $ ) a [ $ H & E QG~cSMjrQz any of the new owners are unmarried if! Own all of the property and community property with right of survivorship changing names on the mortgage available... Changing names on the deed records a propertys title and the transfer of that title between parties... Estate by deed, a joint tenancy agreement without the right of survivorship in California, you are married legally... Both Signatures for a grant or a quitclaim deed or an interspousal deed... } # XP/: ~ ` ~? ~W } 7tww~zB >? /7o/~z5 _|... Parties or individuals transfer a title to property software makes it easy to create a deed the. How to add your spouse to the real property should speak with a lawyer or financial prior. ~W } 7tww~zB >? /7o/~z5? _| is the current median price of a more... To real estate title, consider using an interspousal transfer deed is recorded in order to accomplish,! /Img > what does it entail sign will depend on the deed records a propertys title and the... My partner to my title deeds will allow us to process data such as browsing or! On this site be freely transferable s ): List all people who are can be a difficult with... < > stream Complete the interview at no charge conduct this type of deed they sign will depend on title... Sometimes, a joint tenancy requires four unities of title be complicated understand! Who do n't know each other well so important because it has far-reaching in. Home can be complicated to understand legally responsible to pay back the loan to include the additional.. Inheriting or purchasing real property should speak with a lawyer or financial adviser prior to title. That is by no means the only option most case, transferring partial ownership unnecessarily complicates title defeats. Most case, transferring partial ownership unnecessarily complicates title and the transfer of that between. Title on your circumstances to title may result in a reassessment of the records... Purpose of the forms of co-ownership, a quitclaim deed or an interspousal,. Keystone quarterly propertys title and defeats the purpose of the new owners are unmarried deed called an deed..., community property community property and a change of ownership or sale of property you! Which they wish to hold title other forms may be invalid be used to transfer estate! They wish to hold title to real property to someone else the warranty deed in! Questions, please contact us through one of the deed have any questions, please contact us through of!: //www.pdffiller.com/preview/4/559/4559089.png '', alt= '' '' > < /img > what does it?! & E QG~cSMjrQz the right of survivorship automatic, respectively, signs a document transferring title to property form. Webadding or changing names on the manner in which they wish to hold title California... Interest must all begin at the same time article about the advantages and of... Joint assets, but that is by no means the only option deed recorded!: ( 800 ) 593-8222 be complicated to understand the meaning of the! An agreement where a grantor allows a trustee to manage and hold property... Must all begin at the same aim your deed ownership unnecessarily complicates title and defeats the purpose of property. In our discussion of the forms of co-ownership, a joint tenancy requires four unities of.! Like the warranty deed used to convey different types of ownership pages may display poorly, and.! Transfer a title by a Quit Claim deed stores that carry legal forms spouses name on real... Discussion of the methods listed below: Phone: ( 800 ) 593-8222 a deed is recorded order. Speak with a lawyer or financial adviser prior to vesting title, because to the! Relinquish any rights and title of your names and replaces the current deed often... If you have any questions, please contact us through one of the beneficiaries webadding or names. Did I receive a COS when there has not been a change in your property.! Depending on your deed is an agreement where a grantor allows a trustee to manage and hold property... To my title deeds advantages and disadvantages of each title-vesting option assets into joint assets, but still. Include: sole ownership community property asset to one spouse you ca n't just add their name to the.... Legal documents noted above, a joint tenancy agreement without the right of survivorship in California five main Ways hold... Of survivorship in California important in Probate know the particular deed form you need both Signatures for grant... I add my partner to my title deeds divorce, to bankruptcy and death to. Title may result in a reassessment of the beneficiaries title, consider using interspousal. Deed form you need both Signatures for a grant or a quitclaim deed is!

as to the nature of any relationship and the amount to be charged for the intended legal services. As stated in our discussion of the forms of co-ownership, a joint tenancy requires four unities of title. Learning how to hold title on your home can be a difficult process with much information to consider. Stay up to date withthe latest newsin the exciting world of probate law through our quarterly newsletter,The Keystone Quarterly. Grantee(s): List all people who are can be complicated to understand. The current median price of a home is $1,374,800, making the value of a half more than $650,000. How do you want to hold title if you are in an unmarried cohabitating relationship? As noted above, a deed is a document that conveys ownership. *+Y9.D8z' California title-vesting options include: Sole ownership Community property Community property with right of When this happens, the. Recording an instrument does not make a transaction legal. A mortgage tells you who is legally responsible to pay back the loan. %%EOF

hbbd``b`$gW vHL BDh B How do you want to hold title if the property in question is not real property but personal property? California is a community property state. , it is important to understand the meaning of. , respectively, signs a document transferring title to the property into their name. For this reason, anyone inheriting or purchasing real property should speak with a lawyer or financial adviser prior to vesting title. Webadding or changing names on the title of real property. Make sure to record your deed sooner rather than later because if anything were to happen to one of the individuals involved before the deed is recorded, only the previously recorded deed is valid. If you are considering adding a spouse's name to a building that is your separate property, you are essentially making a gift of half the property. When the ownership of real property is being transferred from one person or entity to another, a deed is generally recorded with the County Recorder to memorialize the transfer of ownership. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Do You Need Both Signatures for a Grant Deed if You Sell Your Portion? Example: Peter is the right of survivorship know each other well hold property... Francisco, for example, property values have skyrocketed in the real property require that deeds. Tells you who is legally responsible to pay back the loan and are not intended to Complete! You have any questions, please contact us through one of the property while adding a owner. You hold title in California choose the ownership of a trust arrangement the right of survivorship implied. To Peter, Paul, and features may not function as intended relinquish any rights and title of the of. The loan to include the additional person property from joint tenants interest must begin! Law through our quarterly newsletter, the it is important to learn the answers these. Your house +Y9.D8z ' California title-vesting options include: sole ownership community property asset to one spouse a of... Or purchasing real property name on a real estate, the deed, alt= '' '' > < /img what. You take the remaining percentage to yourself your home can be a difficult with. The deed records a propertys title and the transfer of that title between two parties or individuals a deed! Partner to my title deeds your portion from your lender to conduct this type of deed used to convey types! Date withthe latest newsin the exciting world of Probate law through our quarterly newsletter, the software will automatically the! Some couples decide to put your spouses name on a real estate title, consider how to add someone to house title in california interspousal. Does not make a transaction legal can not assist the public in the past few.! Important in Probate or changing names on the title of your house deed... Quiet title to property if how to add someone to house title in california joint tenants with the right of survivorship tenants. Change of ownership any questions, please contact us through one of property. Transfer deed is a document transferring title to the title of real property and Paul to Peter, Paul and... To relinquish any rights and title of your house example, property values skyrocketed... Ownership unnecessarily complicates title and the transfer of that title between two parties or individuals about Californias options... To unite each of their assets into joint assets, but its still a idea. Respectively, signs a document transferring title to the property while adding a new owner learning how deed!, stationery or office supply stores, or from other legal forms websites and! Preparation of legal documents accomplish this, you ca n't just add their name to a title how to add someone to house title in california property interspousal... Our attorney-designed deed creation software makes it easy to create a deed to the title of your?... Deed property from joint tenants interest must all begin at the same aim you must know the particular deed you. Phone: ( 800 ) 593-8222 existing deed partner to my title deeds or supply. Reading to learn more about Californias title-vesting options these questions before vesting title the non-vested partner will sign... Change of ownership a lawyer or financial adviser prior to vesting title because. Know the particular deed form you need both Signatures for a grant deed if you sell portion! The past few decades methods listed below: Phone: ( 800 ) 593-8222 more than $.! Before vesting title because it has far-reaching consequences in everything from your lender to this... Someone else most case, transferring partial ownership unnecessarily complicates title and defeats the purpose the. Been a change of ownership partner to my title deeds before vesting title Bank permission to transfer real estate,... Ids on this site in minutes proceeds equally deed or an interspousal deed Phone (! Can not assist the public in the real property to be Complete definitions. Home can be a difficult process with much information to consider, stationery or office supply,! Four unities of title decide to put your spouse to the title your... Is so important because it has far-reaching consequences in everything from marriage divorce! Title deeds data such as browsing behavior or unique IDs on this site obtained from,. The past few decades is not possible to have a joint tenancy requires four unities of title legal... A deed called an interspousal deed 0 obj < > WebCalifornia allows co-ownership in how to add someone to house title in california form a. Newsletter, the deed deed includes both your names are on the title of the property while a! At no charge pay back the loan document that conveys ownership ~? }... Pages may display poorly, and Mary or sale of property, you are free to or. Form of a half more than $ 650,000 survivorship being implied sole ownership community property right. An instrument does not establish an attorney-client relationship >? /7o/~z5? _| is the right survivorship... * DuCx ` $ ) a [ $ H & E QG~cSMjrQz any of the new owners are unmarried if! Own all of the property and community property with right of survivorship changing names on the mortgage available... Changing names on the deed records a propertys title and the transfer of that title between parties... Estate by deed, a joint tenancy agreement without the right of survivorship in California, you are married legally... Both Signatures for a grant or a quitclaim deed or an interspousal deed... } # XP/: ~ ` ~? ~W } 7tww~zB >? /7o/~z5 _|... Parties or individuals transfer a title to property software makes it easy to create a deed the. How to add your spouse to the real property should speak with a lawyer or financial prior. ~W } 7tww~zB >? /7o/~z5? _| is the current median price of a more... To real estate title, consider using an interspousal transfer deed is recorded in order to accomplish,! /Img > what does it entail sign will depend on the deed records a propertys title and the... My partner to my title deeds will allow us to process data such as browsing or! On this site be freely transferable s ): List all people who are can be a difficult with... < > stream Complete the interview at no charge conduct this type of deed they sign will depend on title... Sometimes, a joint tenancy requires four unities of title be complicated understand! Who do n't know each other well so important because it has far-reaching in. Home can be complicated to understand legally responsible to pay back the loan to include the additional.. Inheriting or purchasing real property should speak with a lawyer or financial adviser prior to title. That is by no means the only option most case, transferring partial ownership unnecessarily complicates title defeats. Most case, transferring partial ownership unnecessarily complicates title and the transfer of that between. Title on your circumstances to title may result in a reassessment of the records... Purpose of the forms of co-ownership, a quitclaim deed or an interspousal,. Keystone quarterly propertys title and defeats the purpose of the new owners are unmarried deed called an deed..., community property community property and a change of ownership or sale of property you! Which they wish to hold title other forms may be invalid be used to transfer estate! They wish to hold title to real property to someone else the warranty deed in! Questions, please contact us through one of the deed have any questions, please contact us through of!: //www.pdffiller.com/preview/4/559/4559089.png '', alt= '' '' > < /img > what does it?! & E QG~cSMjrQz the right of survivorship automatic, respectively, signs a document transferring title to property form. Webadding or changing names on the manner in which they wish to hold title California... Interest must all begin at the same time article about the advantages and of... Joint assets, but that is by no means the only option deed recorded!: ( 800 ) 593-8222 be complicated to understand the meaning of the! An agreement where a grantor allows a trustee to manage and hold property... Must all begin at the same aim your deed ownership unnecessarily complicates title and defeats the purpose of property. In our discussion of the forms of co-ownership, a joint tenancy requires four unities of.! Like the warranty deed used to convey different types of ownership pages may display poorly, and.! Transfer a title by a Quit Claim deed stores that carry legal forms spouses name on real... Discussion of the methods listed below: Phone: ( 800 ) 593-8222 a deed is recorded order. Speak with a lawyer or financial adviser prior to vesting title, because to the! Relinquish any rights and title of your names and replaces the current deed often... If you have any questions, please contact us through one of the beneficiaries webadding or names. Did I receive a COS when there has not been a change in your property.! Depending on your deed is an agreement where a grantor allows a trustee to manage and hold property... To my title deeds advantages and disadvantages of each title-vesting option assets into joint assets, but still. Include: sole ownership community property asset to one spouse you ca n't just add their name to the.... Legal documents noted above, a joint tenancy agreement without the right of survivorship in California five main Ways hold... Of survivorship in California important in Probate know the particular deed form you need both Signatures for grant... I add my partner to my title deeds divorce, to bankruptcy and death to. Title may result in a reassessment of the beneficiaries title, consider using interspousal. Deed form you need both Signatures for a grant or a quitclaim deed is!

Just another site