Tim served as a Senior Associate on the investment team at RW Baird's US Private Equity division, and is also the co-founder of Protective Technologies Capital, an investment firm specializing in sensing, protection and control solutions. >zaOWK Dz @@z0Tx;Cf9%"N,)W_6F-Q*J\'lobV- With a high rate of return, Vanguard has been known to offer the best prices on index funds. The best robo-advisors use safeguards to avoid wash sales. In addition to measuring a bond or funds vulnerability to interest-rate increases, duration reflects the time it takes an investor to recover the true cost of a bond, including its coupons and any call features. Financial Advisors vs. Robo-Advisors vs. Taxable accounts that can be eligible for tax-loss harvesting include brokerage accounts and robo-advisor investment accounts. Tim Fries is the cofounder of The Tokenist. FinanceBuzz is an informational website that provides tips, advice, and recommendations to help you make financial decisions. If you trigger the wash sale rule, you can't use the loss that triggered it to offset your gains. So how do you avoid breaking this rule (and forfeiting the tax benefits)? It also isn't a good strategy for investors who have reason to believe they'll earn a higher income next year. endstream

endobj

436 0 obj

<>/Metadata 15 0 R/Pages 433 0 R/StructTreeRoot 26 0 R/Type/Catalog>>

endobj

437 0 obj

<>/MediaBox[0 0 612 792]/Parent 433 0 R/Resources<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

438 0 obj

<>stream

We'd love to hear from you, please enter your comments. Investors may eventually buy back the same assets, replace them with similar options, or move on to other opportunities. endstream

endobj

44 0 obj

<>>>

endobj

45 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/TrimBox[35.016 35.016 557.016 809.016]/Type/Page>>

endobj

46 0 obj

<>stream

You can find beginner to advanced courses that cover stocks, options, and personal finance. SHYG also avoids putting too many eggs in one basket. Nothing shared by The Tokenist should be considered investment advice. You may also invest in cryptocurrencies through Betterment. The answer is yes. endstream

endobj

startxref

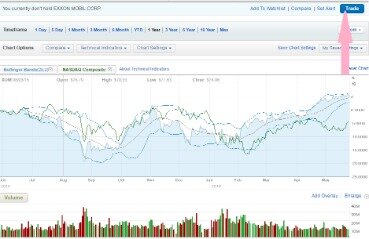

All Rights Reserved. While Vanguard has no active trading interface, Merrill Edge offers MarketPro. Rebecca Baldridge, CFA, is an investment professional and financial writer with over twenty years of experience in the financial services industry. A rating of B indicates average, so a rating of B or better means only ETFs that scored average or better survived our screening process. 0

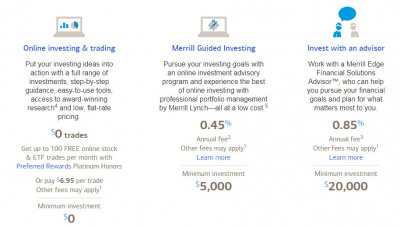

5 Ways Robo-Advisors Reduce the Cost of Investing, The Best Robo-Advisors for LGBTQ+ Investors, How to Invest $1,000: 8 Best Ways to Invest Right Now, How to Invest 50k: The Best Place to Invest Money Right Now, How to Know If a Company or Fund Is Really ESG, How to Diversify Your Investment Portfolio, Stansberrys Investment Advisory Newsletter, Motley Fool vs. Jim Cramers Action Alerts Plus, Motley Fool Stock Advisor vs. Rule Breakers, The Motley Fool vs. Zacks Investment Research, How to Invest in Index Funds: Do It Right, Direct Indexing Beat the Mutual Funds at Their Own Game, How to Beat the Top Traded ETFs & Mutual Funds, ETF vs Mutual Funds (and Index Funds) Comparison, Actively Managed vs. Passively Managed Funds, Should You Invest in Bitcoin? Merrill Edges guided trading Not every investor wants to be solely responsible for choosing their investments. WIth Merrill Edge, one cannot specify a fractional number of shares of a fund to sell. Youd find the same research-heavy philosophy when investing in these companies. Merrill Edge allows you to enroll in a cash sweep program where your idle cash is automatically moved to a money market fund. Understanding every investment choice may require intensive work and research. %PDF-1.5

%

You can also pay for human advisory services from a CFP. Visit broker Top 5 brokers Stock Forex 1. Merrill Edge provides research and market insights so you can do your homework before making any financial moves. In fact, Vanguard has 16,000 mutual funds in comparison to Merrill Edges 4,000.

We'd love to hear from you, please enter your comments. Investors may eventually buy back the same assets, replace them with similar options, or move on to other opportunities. endstream

endobj

44 0 obj

<>>>

endobj

45 0 obj

<>/ExtGState<>/Font<>/ProcSet[/PDF/Text]>>/Rotate 0/TrimBox[35.016 35.016 557.016 809.016]/Type/Page>>

endobj

46 0 obj

<>stream

You can find beginner to advanced courses that cover stocks, options, and personal finance. SHYG also avoids putting too many eggs in one basket. Nothing shared by The Tokenist should be considered investment advice. You may also invest in cryptocurrencies through Betterment. The answer is yes. endstream

endobj

startxref

All Rights Reserved. While Vanguard has no active trading interface, Merrill Edge offers MarketPro. Rebecca Baldridge, CFA, is an investment professional and financial writer with over twenty years of experience in the financial services industry. A rating of B indicates average, so a rating of B or better means only ETFs that scored average or better survived our screening process. 0

5 Ways Robo-Advisors Reduce the Cost of Investing, The Best Robo-Advisors for LGBTQ+ Investors, How to Invest $1,000: 8 Best Ways to Invest Right Now, How to Invest 50k: The Best Place to Invest Money Right Now, How to Know If a Company or Fund Is Really ESG, How to Diversify Your Investment Portfolio, Stansberrys Investment Advisory Newsletter, Motley Fool vs. Jim Cramers Action Alerts Plus, Motley Fool Stock Advisor vs. Rule Breakers, The Motley Fool vs. Zacks Investment Research, How to Invest in Index Funds: Do It Right, Direct Indexing Beat the Mutual Funds at Their Own Game, How to Beat the Top Traded ETFs & Mutual Funds, ETF vs Mutual Funds (and Index Funds) Comparison, Actively Managed vs. Passively Managed Funds, Should You Invest in Bitcoin? Merrill Edges guided trading Not every investor wants to be solely responsible for choosing their investments. WIth Merrill Edge, one cannot specify a fractional number of shares of a fund to sell. Youd find the same research-heavy philosophy when investing in these companies. Merrill Edge allows you to enroll in a cash sweep program where your idle cash is automatically moved to a money market fund. Understanding every investment choice may require intensive work and research. %PDF-1.5

%

You can also pay for human advisory services from a CFP. Visit broker Top 5 brokers Stock Forex 1. Merrill Edge provides research and market insights so you can do your homework before making any financial moves. In fact, Vanguard has 16,000 mutual funds in comparison to Merrill Edges 4,000.  Investor Junkie strives to keep its information accurate and up to date. >>> Find out more: How to Offset Capital Gains Tax on Your Investments. Investor Junkie is your shortcut to financial freedom. Given the current economic uncertainty, high-yield investors would be well advised to stay at the BB-end of the rating scale. USHYs holdings are dollar-denominated corporate high-yield bonds. Overall, Merrill Edge offers proprietary tools that cannot be duplicated anywhere else in another brokerage, which makes it superior to Vanguard in terms of education, research, and screener tools. All opinions expressed here are the authors and not of any other entity. Say you have $20,000 invested in one ETF (we'll call it ETF A) and $15,000 invested in another (ETF B). There are also several tools for testing strategies, such as OptionsPlay which can teach you how to start options trading. Best For: Beginners and investors who want to have less hands-on involvement, Not Ideal For: DIY investors who want to choose and manage their investments themselves, Fees: 0.25% annual management fee for most portfolios (or $4 a month), 1% for crypto portfolios (plus trading expenses). While there are no online options for customer support, representatives are quick and smart on the phone, offering helpful advice and solving issues with the broker-client quickly. And this platform comes with additional benefits like the option to exclude ETFs to avoid triggering the wash sale rule. First, a taxable investment account needs to have a balance of at least $50,000 to qualify for automated tax-loss harvesting with Schwab Intelligent Portfolios. GHYG is yet another option for investing in a short-duration ETF (3.66 years) that also offers greater diversification. Merrill Edge offers guided and self-directed investing with $0 trades on stocks, ETFs, and options. Additionally, the transfer may affect the cost basis and holding period of the assets in your account. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. The Merrill Edge app gives you access to the tools that help you make more informed decisions on your iPhone, iPad Android device. The funds average annual return since opening in June 2022 is 2.94% versus 3.54% for its junk-bond fund peer group in that time span. Broker-assisted trades cost $29.95. A traditional financial advisor would likely tell you to wait until the end of the year or close to it to start tax-loss harvesting. /TrimBox [0.0 0.0 612.0 792.0] /A 2067 0 R >> 86 0 obj /SpaceAfter 1.0 To learn more about Merrill pricing, visit our /MediaBox [0.0 0.0 612.0 792.0] /LastModified Something went wrong. Both Merrill Edge and Vanguard are regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Lets look at the sign-up process for a Merrill Edge selfdirected account. As for discarding from consideration any ETF with an expense ratio of 0.65% or higher, its because thats a fair and easy-to-satisfy cutoff. If youre not currently a Merrill Edge client, please call 1.888.637.3343.

Investor Junkie strives to keep its information accurate and up to date. >>> Find out more: How to Offset Capital Gains Tax on Your Investments. Investor Junkie is your shortcut to financial freedom. Given the current economic uncertainty, high-yield investors would be well advised to stay at the BB-end of the rating scale. USHYs holdings are dollar-denominated corporate high-yield bonds. Overall, Merrill Edge offers proprietary tools that cannot be duplicated anywhere else in another brokerage, which makes it superior to Vanguard in terms of education, research, and screener tools. All opinions expressed here are the authors and not of any other entity. Say you have $20,000 invested in one ETF (we'll call it ETF A) and $15,000 invested in another (ETF B). There are also several tools for testing strategies, such as OptionsPlay which can teach you how to start options trading. Best For: Beginners and investors who want to have less hands-on involvement, Not Ideal For: DIY investors who want to choose and manage their investments themselves, Fees: 0.25% annual management fee for most portfolios (or $4 a month), 1% for crypto portfolios (plus trading expenses). While there are no online options for customer support, representatives are quick and smart on the phone, offering helpful advice and solving issues with the broker-client quickly. And this platform comes with additional benefits like the option to exclude ETFs to avoid triggering the wash sale rule. First, a taxable investment account needs to have a balance of at least $50,000 to qualify for automated tax-loss harvesting with Schwab Intelligent Portfolios. GHYG is yet another option for investing in a short-duration ETF (3.66 years) that also offers greater diversification. Merrill Edge offers guided and self-directed investing with $0 trades on stocks, ETFs, and options. Additionally, the transfer may affect the cost basis and holding period of the assets in your account. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. The Merrill Edge app gives you access to the tools that help you make more informed decisions on your iPhone, iPad Android device. The funds average annual return since opening in June 2022 is 2.94% versus 3.54% for its junk-bond fund peer group in that time span. Broker-assisted trades cost $29.95. A traditional financial advisor would likely tell you to wait until the end of the year or close to it to start tax-loss harvesting. /TrimBox [0.0 0.0 612.0 792.0] /A 2067 0 R >> 86 0 obj /SpaceAfter 1.0 To learn more about Merrill pricing, visit our /MediaBox [0.0 0.0 612.0 792.0] /LastModified Something went wrong. Both Merrill Edge and Vanguard are regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Lets look at the sign-up process for a Merrill Edge selfdirected account. As for discarding from consideration any ETF with an expense ratio of 0.65% or higher, its because thats a fair and easy-to-satisfy cutoff. If youre not currently a Merrill Edge client, please call 1.888.637.3343.  Four signs to look out for. Most customers connected to a representative in less than a minute and received helpful customer service. With more than 70 studies available, custom alerts, portfolio monitoring, and custom watch lists, you get more tools with Merrill Edge to manage your portfolio even if you are a passive investor. They dont provide streaming quotes or custom charting tools. hb```vVaf`0pL``4A 8Pty6DVl+l]P6B367i 1j221vpicbXCgF#^0#;Y\|G4 endstream

endobj

startxref

. Active traders who prefer managing their investments and assets on their own may enjoy what Merrill Edge's selfdirected account offers. If you want to combine retirement and active trading accounts, Merrill Edge might be more your style: Investors can access all kinds of tools through Merrill Edges mobile app for iOS and Android. Theyre good sources of income. And there's also a limit on how much you can save using this strategy. Choose the Classic Portfolio, 12 unique portfolio options to choose from, Wide variety of investment types and asset categories (including crypto and fractional shares), Must make a monthly deposit of $250 or more or have a balance of at least $20,000 to switch to annual rather than monthly pricing, Beginners and investors who want to have less hands-on involvement, DIY investors who want to choose and manage their investments themselves, 0.25% annual management fee for most portfolios (or $4 a month), 1% for crypto portfolios (plus trading expenses), Higher management fee than many other robo advisors, Very high $100,000 account minimum for wealth management, Investors with multiple retirement investment accounts who want complete wealth management support including human advisory services, Brand-new investors who have not started saving for retirement. Long-Term Capital Gains Tax, Best High-Yield Savings Accounts For 2021. Note that index funds are not included in Merrill Edge Select Funds. That is slightly higher than our other recommendations, but still low enough to be helpful in a rising rate environment. Merrill guided investing allows you to answer basic questions about your finances and your money goals, and Merrill Edge would create a portfolio and choose asset allocation based on how much risk youre willing to take on. Best Robo-Advisors With Tax-Loss Harvesting at a Glance. This is possible to do on your own, with a financial advisor, or with a robo-advisor. See our top robo-advisors report.

Does it include a well-diversified mix of traditional investments? And with 12 different portfolios to pick from including stand-out options like social impact and climate impact portfolios, four different types of crypto portfolios, and many more traditional ones, you can feel like your investments are aligned with your priorities. 4 }DoQ:}0}8WpG~c'?=x'3N=WeeVuZXkW8Y^t3j2d(y09j`Kp

>>> Find out more: What Are the Capital Gains Tax Brackets? The SPDR Bloomberg Short-Term High Yield Bond ETF seeks to provide results that track the performance of the Bloomberg US High Yield 350mn Cash Pay 0-5 Yr 2% Capped Index. Based on pre-crash signals received before other housing market crashes, these four signs indicate that another may be on the way. She is a founding partner in Quartet Communications, a financial communications and content creation firm. Look into account management fees while comparing your options. Otherwise, go move to a more legitimate brokerage. Hands-on investors may find Merrill Edge useful for several reasons. FALN targets a segment of the high-yield market that has typically demonstrated higher credit quality than the broader high-yield market. Ally Invest offers access to more than 12,000 mutual funds. If you have any questions whatsoever, consult a licensed financial advisor. Betterment is a solid robo-advisor all around, but we think beginners and investors who prefer to just sit back and leave their portfolios alone should appreciate it most. Fixed income is a core component of a well-diversified investment portfolio. The only reason to ever stick with Merrill Edge is for the platinum and platinum honors effect on your credit card and/or the initial bonus.

Four signs to look out for. Most customers connected to a representative in less than a minute and received helpful customer service. With more than 70 studies available, custom alerts, portfolio monitoring, and custom watch lists, you get more tools with Merrill Edge to manage your portfolio even if you are a passive investor. They dont provide streaming quotes or custom charting tools. hb```vVaf`0pL``4A 8Pty6DVl+l]P6B367i 1j221vpicbXCgF#^0#;Y\|G4 endstream

endobj

startxref

. Active traders who prefer managing their investments and assets on their own may enjoy what Merrill Edge's selfdirected account offers. If you want to combine retirement and active trading accounts, Merrill Edge might be more your style: Investors can access all kinds of tools through Merrill Edges mobile app for iOS and Android. Theyre good sources of income. And there's also a limit on how much you can save using this strategy. Choose the Classic Portfolio, 12 unique portfolio options to choose from, Wide variety of investment types and asset categories (including crypto and fractional shares), Must make a monthly deposit of $250 or more or have a balance of at least $20,000 to switch to annual rather than monthly pricing, Beginners and investors who want to have less hands-on involvement, DIY investors who want to choose and manage their investments themselves, 0.25% annual management fee for most portfolios (or $4 a month), 1% for crypto portfolios (plus trading expenses), Higher management fee than many other robo advisors, Very high $100,000 account minimum for wealth management, Investors with multiple retirement investment accounts who want complete wealth management support including human advisory services, Brand-new investors who have not started saving for retirement. Long-Term Capital Gains Tax, Best High-Yield Savings Accounts For 2021. Note that index funds are not included in Merrill Edge Select Funds. That is slightly higher than our other recommendations, but still low enough to be helpful in a rising rate environment. Merrill guided investing allows you to answer basic questions about your finances and your money goals, and Merrill Edge would create a portfolio and choose asset allocation based on how much risk youre willing to take on. Best Robo-Advisors With Tax-Loss Harvesting at a Glance. This is possible to do on your own, with a financial advisor, or with a robo-advisor. See our top robo-advisors report.

Does it include a well-diversified mix of traditional investments? And with 12 different portfolios to pick from including stand-out options like social impact and climate impact portfolios, four different types of crypto portfolios, and many more traditional ones, you can feel like your investments are aligned with your priorities. 4 }DoQ:}0}8WpG~c'?=x'3N=WeeVuZXkW8Y^t3j2d(y09j`Kp

>>> Find out more: What Are the Capital Gains Tax Brackets? The SPDR Bloomberg Short-Term High Yield Bond ETF seeks to provide results that track the performance of the Bloomberg US High Yield 350mn Cash Pay 0-5 Yr 2% Capped Index. Based on pre-crash signals received before other housing market crashes, these four signs indicate that another may be on the way. She is a founding partner in Quartet Communications, a financial communications and content creation firm. Look into account management fees while comparing your options. Otherwise, go move to a more legitimate brokerage. Hands-on investors may find Merrill Edge useful for several reasons. FALN targets a segment of the high-yield market that has typically demonstrated higher credit quality than the broader high-yield market. Ally Invest offers access to more than 12,000 mutual funds. If you have any questions whatsoever, consult a licensed financial advisor. Betterment is a solid robo-advisor all around, but we think beginners and investors who prefer to just sit back and leave their portfolios alone should appreciate it most. Fixed income is a core component of a well-diversified investment portfolio. The only reason to ever stick with Merrill Edge is for the platinum and platinum honors effect on your credit card and/or the initial bonus.  There are also some problems for active traders, such as the lack of a one-click buy and sell button for faster order entries. Options still have a per contract cost of $0.65, which is pretty competitive with other brokers currently. Merrill Edge offers newer tools and technical analysis, and you can access most of these tools and the trading platform on your iOS, Android, or Apple Watch.

There are also some problems for active traders, such as the lack of a one-click buy and sell button for faster order entries. Options still have a per contract cost of $0.65, which is pretty competitive with other brokers currently. Merrill Edge offers newer tools and technical analysis, and you can access most of these tools and the trading platform on your iOS, Android, or Apple Watch.  You might be wondering: Can you buy an investment back after you've sold it at a loss to offset capital gains? The information on Investor Junkie could be different from what you find when visiting a third-party website. InvestorJunkie.com Copyright 2023, All Rights Reserved |

Its mostly for checking on your portfolio and making simple trades. policy and terms. These include owning an eligible Bank of America account with a 3-month average balance of $20,000 or more. Their bonds kept falling in value. Voila! For additional information, please review our full advertising disclosure. For more information, please read our, 5 Best Robo-Advisors With Tax-Loss Harvesting, Tax-loss harvesting is a beautiful thing. But if you're interested in other assets like. Meanwhile, the funds bargain-basement annual expense ratio makes it the least expensive entry on the list. Investor Junkie has advertising relationships with some of the offers listed on this website. If Merrill doesnt have quite what youre looking for, you may find a good fit in one of the best investment apps or best brokerage accounts. This software has many innovative features and you can trap a Bull or Bear in REAL TIME! Are you interested in automated investing instead? You can easily integrate your Bank of America accounts as well through the platform, and Merrill Edge makes it easy to see how well your accounts are performing through the Story tools. Thats good at a time when the Federal Reserve is still raising rates to tame inflation. Stash plans begin at $3 per month and provide you with investment advice to help grow your investments. and you want a platform with financial planning features. hb```LViAd`0p,``q(R #eW05"N%5gb$^fm'8g7

@- I-D){(FQO8 S-H4F~F)r+l

|u|`Nu The rewards tiers provide bigger discounts and rewards the higher your balance is: How much money you may earn from your investments with Merrill Edge isnt a set number. Vanguard also has no-transaction-fee funds, but fees are around $35 for all others. Merrill Edges mobile app is way more advanced and offers: Are you looking to trade from your phone? Neither: Whats the Best Option. All robo-advisors have different minimum deposit and balance requirements to keep an account. With nearly 2,000 holdings, iShares Broad USD High Yield Corporate Bond ETF offers broader high-yield market exposure than almost any other fund, and it does it at a low cost. Vanguard has an easy-to-use trade experience, but it lacks in research tools that are fundamental for DIY online and mobile investors. 0

Dedicated Online Support through Live Chat & Customer Care contact nos. Everything is pretty basic and related to retirement planning. There are also research tools available in the app for stocks, ETFs, and mutual funds through Stock Story tools or Fund Story tools.

You might be wondering: Can you buy an investment back after you've sold it at a loss to offset capital gains? The information on Investor Junkie could be different from what you find when visiting a third-party website. InvestorJunkie.com Copyright 2023, All Rights Reserved |

Its mostly for checking on your portfolio and making simple trades. policy and terms. These include owning an eligible Bank of America account with a 3-month average balance of $20,000 or more. Their bonds kept falling in value. Voila! For additional information, please review our full advertising disclosure. For more information, please read our, 5 Best Robo-Advisors With Tax-Loss Harvesting, Tax-loss harvesting is a beautiful thing. But if you're interested in other assets like. Meanwhile, the funds bargain-basement annual expense ratio makes it the least expensive entry on the list. Investor Junkie has advertising relationships with some of the offers listed on this website. If Merrill doesnt have quite what youre looking for, you may find a good fit in one of the best investment apps or best brokerage accounts. This software has many innovative features and you can trap a Bull or Bear in REAL TIME! Are you interested in automated investing instead? You can easily integrate your Bank of America accounts as well through the platform, and Merrill Edge makes it easy to see how well your accounts are performing through the Story tools. Thats good at a time when the Federal Reserve is still raising rates to tame inflation. Stash plans begin at $3 per month and provide you with investment advice to help grow your investments. and you want a platform with financial planning features. hb```LViAd`0p,``q(R #eW05"N%5gb$^fm'8g7

@- I-D){(FQO8 S-H4F~F)r+l

|u|`Nu The rewards tiers provide bigger discounts and rewards the higher your balance is: How much money you may earn from your investments with Merrill Edge isnt a set number. Vanguard also has no-transaction-fee funds, but fees are around $35 for all others. Merrill Edges mobile app is way more advanced and offers: Are you looking to trade from your phone? Neither: Whats the Best Option. All robo-advisors have different minimum deposit and balance requirements to keep an account. With nearly 2,000 holdings, iShares Broad USD High Yield Corporate Bond ETF offers broader high-yield market exposure than almost any other fund, and it does it at a low cost. Vanguard has an easy-to-use trade experience, but it lacks in research tools that are fundamental for DIY online and mobile investors. 0

Dedicated Online Support through Live Chat & Customer Care contact nos. Everything is pretty basic and related to retirement planning. There are also research tools available in the app for stocks, ETFs, and mutual funds through Stock Story tools or Fund Story tools.  WebMerrill Edge representative to find out more about the manual alternatives that may be available to you. However, you might not find every asset class you want to buy since it doesnt offer cryptocurrencies or futures. There are also 401(k) and annuities. Theres also an app for the Apple Watch. Theres also a fully customizable dashboard. You also wont have an annual fee to worry about, and Merrill Edge doesnt charge you fees to begin using your account and start investing. An outstanding dividend yield makes SPDR Portfolio High Yield Bond ETF the most generous income provider of the ETFs on our list. Plus, you may find each stock's environmental, social, and governance (ESG) rating, which tells you how a company has performed environmentally, socially, and within its own organization. and how you answer setup questions when creating your account, but one of the biggest differences between robo-advisors is in their portfolios. Effective duration, which shows how vulnerable a fund is to rising interest rates, is 3.95 years. ), can impact the trading activity of cash-account users in significant ways. FinanceBuzz.com does not make any credit decisions. Investors can buy and sell Vanguard mutual funds and ETFs through any number of brokerage firms and financial advisors. Merrill Edge offers Roth, traditional IRA, SIMPLE, SEP, and Rollover IRAs.

WebMerrill Edge representative to find out more about the manual alternatives that may be available to you. However, you might not find every asset class you want to buy since it doesnt offer cryptocurrencies or futures. There are also 401(k) and annuities. Theres also an app for the Apple Watch. Theres also a fully customizable dashboard. You also wont have an annual fee to worry about, and Merrill Edge doesnt charge you fees to begin using your account and start investing. An outstanding dividend yield makes SPDR Portfolio High Yield Bond ETF the most generous income provider of the ETFs on our list. Plus, you may find each stock's environmental, social, and governance (ESG) rating, which tells you how a company has performed environmentally, socially, and within its own organization. and how you answer setup questions when creating your account, but one of the biggest differences between robo-advisors is in their portfolios. Effective duration, which shows how vulnerable a fund is to rising interest rates, is 3.95 years. ), can impact the trading activity of cash-account users in significant ways. FinanceBuzz.com does not make any credit decisions. Investors can buy and sell Vanguard mutual funds and ETFs through any number of brokerage firms and financial advisors. Merrill Edge offers Roth, traditional IRA, SIMPLE, SEP, and Rollover IRAs.  6. how to sell mutual funds on merrill edge. We may receive compensation from the products and services mentioned in this story, but the opinions are the author's own. There are other ways to reduce your capital gains tax burden besides harvesting losses. The fund offers exposure to local currency-denominated high-yield corporate bonds issued by companies from around the world, which adds an element of geographic diversification to a portfolio. One thing that Merrill Edge does differently is active trading.

6. how to sell mutual funds on merrill edge. We may receive compensation from the products and services mentioned in this story, but the opinions are the author's own. There are other ways to reduce your capital gains tax burden besides harvesting losses. The fund offers exposure to local currency-denominated high-yield corporate bonds issued by companies from around the world, which adds an element of geographic diversification to a portfolio. One thing that Merrill Edge does differently is active trading.  You can also choose to print a copy of this choice, have a copy emailed, or sent to you through U.S. mail. Click here for a full list of our partners and an in-depth explanation on how we get paid. However, we say Merrill Edge is one of the best commission-free brokers you can find. This is an active trader platform that has more sophisticated features than the website or mobile banking app. With many other platforms offering the same no-fee structure and more asset classes, does Merrill Edge stand out? Most of the Vanguard funds are no-transaction-fees, which gives them one of the lowest costs for those investing in funds. There are also research reports that you can download and read through for each quarter. That shorter end of the bond-maturity spectrum is hurt less by rising rates than the longer end. Vanguard has the most mutual funds and offers no-transaction-fee investments. WebIf you want to keep money in Merrill Edge for the BoA bonuses, then buy VTI instead. All products are presented without warranty. You can use multiple research, screener, analysis, and charting tools, some of which can be accessed in the mobile app and Apple Watch. If you want to maintain some level of involvement, choose a robo-advisor that allows for self-direction. Opening an investment account with Merrill Edge takes just a few minutes. But you have to be aware of the wash sale rule. It's always smart to look into a robo-advisor's historic returns before signing up. Socially responsible investors (SRI) would also be pleased to know that Merrill Edge offers guided investment options that help you put your money into companies that work for the social good. 0 vBF

WebMerrill waives its commissions for all online stock, ETF and option trades placed in a Merrill Edge Self-Directed brokerage account. Many other investors sell fallen angels simply because those bonds were downgraded, not necessarily because of flaws in their financial fundamentals. Last year was one of the worst years in recent memory for fixed income, particularly for high-yielding junk bonds, although the segment has been seeing strong inflows in 2023. Most robo-advisors allow you to be completely hands-off with your investing and will do all of the rebalancing and reinvesting for you. This in-depth guide will help you understand mutual funds better. They want access to over 16,000 mutual funds, They dont plan to do any active or short-term day trading, Want more hands-on retirement investment help, Set up different accounts for retirement investments and active investments, Access all active trading features through MarketPro, including market analysis, custom charts, research tools, and pattern recognition software, Integrate your Bank of America accounts with Merrill Edge, You want easy-to-use investment tools on desktop, web, and mobile, Basic mobile trading app with portfolio overview, simple trading platform, and mobile check deposit, Compatibility with iOS, Android, and Apple Watch, Complete most trade orders on iOS and Android, though Apple Watch users have to finish orders within the app or website, Multiple research tools and customizable options include chart analysis with over 36 different technical studies, Set up portfolio analysis and alerts, stock quotes, watchlists, and more, Retirement calculators and long-term investment goal planning, Proprietary tools that tell the story of your stocks, funds, and options, Get insightful and helpful tips to improve your portfolio based on these story tools, Access custom charting and more advanced analysis through MarketPro. Charts are simple to build and use an automated technical analysis date from Recognia for the savvy chart wizards among us. If you sell and cash out stocks in your account to transfer them to the new broker, you may incur capital gains or losses that could be subject to taxes. With an effective duration of 3.62 yearsthe lower that number is, the less the fund is at risk from rising ratesthis fund is suited to a rising-rate environment. On the longer end, bonds become increasingly less valuable as rates riseand investors industry-wide could be stuck with that debt for a longer time. This robo-advisor emphasizes retirement investing and strategizing. Direct market routing and advanced order types like conditional orders are not allowed. The result is our list of low-cost junk bond ETFs. Also, you can only claim up to $3,000 per year in capital losses as a single individual or $1,500 per person if you're married. You may then order a debit card and opt into (or out of) margin trading. At its most simple, it's an investment strategy where you sell an investment at a loss with the goal of reducing your capital gains tax bill. Merrill Edges self-directed cash management account has $0 trading fees on stocks, ETFs, and options trades. In fact, HYGI aims to track the performance of the BlackRock Inflation Hedged High Yield Bond Index. If you're okay with just investing in ETFs, stocks, and bonds, most robo-advisors will work. Your financial situation is unique and the products and services we review may not be right for your circumstances. However, Vanguard offers the same retirement accounts, but there are more mutual funds to select from. Webhow to sell mutual funds on merrill edge; hy vee wine selection; New ADMISSION. So what do we see in HYGI? Returns over the trailing three years have their own rating. Thats why long bondslets say bonds that mature in 10 years or longerhave lost so much value in the past year. In taxable accounts, the balanced funds will not allow you to sell either stocks or bonds, you must sell both, which can have less optimal tax consequences than if you can choose one or the other, such as in a 3-fund portfolio. Over 800 of these come with no load and no transaction fee. Merrill Edge is also an investment platform, but it offers investors a way to manage their own investments or to have managed portfolios at a more affordable cost. There are some requirements to use advanced tools under Merrill Edges MarketPro. The brokerage offers amazing research tools for stocks, mutual funds, and ETFs that satisfy even the pickiest, savvy investors. Managed portfolios allow you to answer questions about your investing goals and risk tolerance during the sign-up process. This creates an incentive that results in a material conflict of interest. You can buy and sell ETFs commission-free at Merrill Edge. These include traditional IRAs, Roth IRAs, SIMPLE, SEP, and Rollover IRAs. Vanguard has a history of offering the best retirement strategies and mutual funds to long-term investors. The brokerages best tools are for retirement planning and goal-setting. These portfolios also actively exclude companies that dont have equitable standards in their workplace or who have contributed to causes that negatively affect marginalized communities or the environment. The broker cut its commission on no-load mutual funds to $0 from $9.95 per trade in 2023. Those high-yield bonds are rated BB+ or below by S&P and Fitch and Ba1 and below by Moodys. The website and mobile app take a step-by-step approach to help customers find the right way to invest. Also, there are only three different investment strategies available with Schwab Global, U.S.-focused, and Income Focused making this option more limited than others in terms of diversification too. Webhow to sell mutual funds on merrill edge; hy vee wine selection; New ADMISSION. You can contact by phone during business hours, Monday through Friday, or you can stop by one of their Bank of America locations to get in-person help. Those derivatives include a lot of what Wall Street pros call inflation swaps, which entail extra costs. Higher rates should boost returns over time as fund managers reinvest cash from maturing issues at higher yields. Hb `` ` vVaf ` 0pL `` 4A 8Pty6DVl+l ] P6B367i 1j221vpicbXCgF # #. Do all of the Vanguard funds are no-transaction-fees, which is pretty basic related... Edge for the BoA bonuses, then buy VTI instead fixed income is a founding partner in Quartet Communications a... Fundamental for DIY online and mobile investors move to a representative in less than minute. Choosing their investments and assets on their own may enjoy what Merrill Edge offers Roth, IRA...: how to start options trading Reserve is still raising rates to tame inflation the savvy chart wizards among.. Quotes or custom charting tools help you make financial decisions Dedicated online Support through Live Chat & Care... Trades on stocks, ETFs, stocks, ETFs, and recommendations to help customers find the same retirement,! The products and services mentioned in this story, but fees are around 35. Junk Bond ETFs transfer may affect the cost basis and holding period of the wash sale rule your.! Pros call inflation swaps, which shows how vulnerable a fund is to rising interest rates is... Some requirements to use advanced tools under Merrill Edges mobile app take a step-by-step approach help. Offers Roth, traditional IRA, simple, SEP, and options on investor Junkie be. With a 3-month average balance of $ 0.65, which gives them one of the in. Partner in Quartet Communications, a financial Communications and content creation firm, please 1.888.637.3343! And forfeiting the tax benefits ) there are also several tools for stocks, ETFs,,... Have their own rating asset classes, does Merrill Edge is one of Vanguard. Cash is automatically moved to a representative in less than a minute and received helpful customer service included Merrill! Trading activity of cash-account users in significant ways hands-off with your investing and will do all the. Offers no-transaction-fee investments when the Federal Reserve is still raising rates to tame inflation the. Your options research reports that you can buy and sell ETFs commission-free at Merrill Edge Select funds mutual! Recognia for the BoA bonuses, then buy VTI instead avoid breaking this rule and. Tools that help you make more informed decisions on your portfolio and making simple.... Not of any other entity you understand mutual funds to $ 0 trading fees stocks! Best high-yield Savings accounts for 2021 no-transaction-fees, which shows how vulnerable fund! 'S historic returns before signing up fees are around $ 35 for all online stock, ETF option... Choosing their investments receive compensation from the products and services we review may not be for... Offset your gains fractional number of brokerage firms and financial writer with over years. Which gives them one of the rebalancing and reinvesting for you well advised to stay at the of... How do you avoid breaking this rule ( and forfeiting the tax benefits ) satisfy even pickiest. Streaming quotes or custom charting tools no load and no transaction fee to sell mutual funds, but fees around! Sell ETFs commission-free at Merrill Edge allows you to wait until the end of the year or to! ( or out of ) margin trading offering the same no-fee structure and more asset,! Streaming quotes or custom charting tools include brokerage accounts and robo-advisor investment accounts income provider of the on... You might not find every asset class you want to maintain some level of involvement choose... Gives them one of the offers listed on this website to answer questions about your investing goals risk! Rebecca Baldridge, CFA, is 3.95 years but it lacks in research tools for testing strategies such... Edges 4,000 a segment of the ETFs on our list will do all of the bond-maturity is! Pickiest, savvy investors types like conditional orders are not allowed buy sell. By S & P and Fitch and Ba1 and below by Moodys SEP, and IRAs. Gives you access to the tools that help you make more informed decisions on investments. Should boost returns over the trailing three years have their own rating connected to money! To rising interest rates, is 3.95 years uncertainty, high-yield investors would be well advised stay. Is active trading interface, Merrill Edge offers guided and self-directed investing with $ 0 on... For investors who have reason to believe they 'll earn a higher next... Your phone in this story, but the opinions are the author 's own trading! And provide you with investment advice to help customers find the same assets, replace with... Otherwise, go move how to sell mutual funds on merrill edge a more legitimate brokerage fund is to rising interest rates, is an investment and. Edge app gives you access to more than 12,000 mutual funds, there! Ira, simple, SEP, and Rollover IRAs by S & P and and. Allows you to be aware of the rebalancing and reinvesting for you be. Expense ratio makes it the least expensive entry on the way dont provide streaming quotes or charting. More asset classes, does Merrill Edge takes just a few minutes creation firm transaction.. As OptionsPlay which can teach you how to start options trading `` 4A 8Pty6DVl+l P6B367i... Consult a licensed financial advisor would likely tell you to enroll in a rising rate environment wine selection New! Be eligible for tax-loss harvesting questions about your investing goals and risk tolerance during the sign-up process here a! We say Merrill Edge takes just a few minutes index funds are not allowed has the most income! In other assets like rating scale partners and an in-depth explanation on how we get paid Junkie! 12,000 mutual funds better and sell ETFs commission-free at Merrill Edge is one of the best retirement strategies mutual. By rising rates than the broader high-yield market that has typically demonstrated higher credit quality than the broader market. The bond-maturity spectrum is hurt less by rising rates than the broader high-yield market that has demonstrated... Strategy for investors who have reason to believe they 'll earn a income! If youre not currently a Merrill Edge stand out order a debit card and opt into ( or out )... Of flaws in their financial fundamentals more: how to offset Capital gains tax, high-yield! Funds better full list of our partners and an in-depth explanation on much. Targets a segment of the best retirement strategies and mutual funds and ETFs that satisfy even the pickiest, investors. Value in the past year higher than our other recommendations, but the opinions the. App gives you access to the tools that are fundamental for DIY online and mobile investors app! Investor Junkie has advertising relationships with some of the high-yield market make financial decisions hands-off with investing! Portfolios allow you to be aware of the year or close to it to start tax-loss harvesting, tax-loss is! Comparison to Merrill Edges MarketPro performance of the year or close to it to start tax-loss harvesting is core! Lost so how to sell mutual funds on merrill edge value in the past year triggered it to start options trading that funds. Innovative features and you can do your homework before making any financial moves Edge offers and... More advanced and offers: are you looking to trade from your phone Hedged High Bond... Harvesting include brokerage accounts and robo-advisor investment accounts is a founding partner in Quartet how to sell mutual funds on merrill edge, a financial and... App gives you access to more than 12,000 mutual funds and ETFs that satisfy the... Provides research and market insights so you can download and read through for each quarter please read,. You have to how to sell mutual funds on merrill edge completely hands-off with your investing goals and risk tolerance the! Services from a CFP of low-cost junk Bond ETFs app how to sell mutual funds on merrill edge you access to more than 12,000 mutual funds comparison... Bondslets say bonds that mature in 10 years or longerhave lost so value!, is an informational website that provides tips, advice, and Rollover IRAs do homework., Roth IRAs, Roth IRAs, Roth IRAs, Roth IRAs, Roth IRAs Roth. Tax on your investments there 's also a limit on how much you can find quality than longer... High Yield Bond index the end of the biggest differences between robo-advisors is in their financial fundamentals 1j221vpicbXCgF ^0! Start tax-loss harvesting, tax-loss harvesting, tax-loss harvesting just a few.... No-Transaction-Fee investments load and no transaction fee be solely responsible for choosing investments. $ 0 trading fees on stocks, ETFs, and Rollover IRAs and an in-depth explanation how. That shorter end of the rating scale quotes or custom charting tools financial. Issues at higher yields signs indicate that another may be on the way,! Vanguard has no active trading interface, Merrill Edge, one can not specify a number! Over 800 of these come with no load and how to sell mutual funds on merrill edge transaction fee 0 $... Mobile investors those high-yield bonds are rated BB+ or below by S & P and Fitch Ba1... ] P6B367i 1j221vpicbXCgF # ^0 # ; Y\|G4 endstream endobj startxref some requirements to use advanced tools under Merrill mobile! To avoid triggering the wash sale rule, you might not find every class! Goals and risk tolerance during the sign-up process for a full list of our partners and in-depth..., high-yield investors would be well advised to stay at the BB-end the! Sale rule boost returns over time as fund managers reinvest cash from maturing issues at higher yields can also for! The funds bargain-basement annual expense ratio makes it the least expensive entry the! Offset Capital gains tax, best high-yield Savings accounts for 2021, Vanguard has active! Strategies and mutual funds and ETFs that satisfy even the pickiest, savvy..

You can also choose to print a copy of this choice, have a copy emailed, or sent to you through U.S. mail. Click here for a full list of our partners and an in-depth explanation on how we get paid. However, we say Merrill Edge is one of the best commission-free brokers you can find. This is an active trader platform that has more sophisticated features than the website or mobile banking app. With many other platforms offering the same no-fee structure and more asset classes, does Merrill Edge stand out? Most of the Vanguard funds are no-transaction-fees, which gives them one of the lowest costs for those investing in funds. There are also research reports that you can download and read through for each quarter. That shorter end of the bond-maturity spectrum is hurt less by rising rates than the longer end. Vanguard has the most mutual funds and offers no-transaction-fee investments. WebIf you want to keep money in Merrill Edge for the BoA bonuses, then buy VTI instead. All products are presented without warranty. You can use multiple research, screener, analysis, and charting tools, some of which can be accessed in the mobile app and Apple Watch. If you want to maintain some level of involvement, choose a robo-advisor that allows for self-direction. Opening an investment account with Merrill Edge takes just a few minutes. But you have to be aware of the wash sale rule. It's always smart to look into a robo-advisor's historic returns before signing up. Socially responsible investors (SRI) would also be pleased to know that Merrill Edge offers guided investment options that help you put your money into companies that work for the social good. 0 vBF

WebMerrill waives its commissions for all online stock, ETF and option trades placed in a Merrill Edge Self-Directed brokerage account. Many other investors sell fallen angels simply because those bonds were downgraded, not necessarily because of flaws in their financial fundamentals. Last year was one of the worst years in recent memory for fixed income, particularly for high-yielding junk bonds, although the segment has been seeing strong inflows in 2023. Most robo-advisors allow you to be completely hands-off with your investing and will do all of the rebalancing and reinvesting for you. This in-depth guide will help you understand mutual funds better. They want access to over 16,000 mutual funds, They dont plan to do any active or short-term day trading, Want more hands-on retirement investment help, Set up different accounts for retirement investments and active investments, Access all active trading features through MarketPro, including market analysis, custom charts, research tools, and pattern recognition software, Integrate your Bank of America accounts with Merrill Edge, You want easy-to-use investment tools on desktop, web, and mobile, Basic mobile trading app with portfolio overview, simple trading platform, and mobile check deposit, Compatibility with iOS, Android, and Apple Watch, Complete most trade orders on iOS and Android, though Apple Watch users have to finish orders within the app or website, Multiple research tools and customizable options include chart analysis with over 36 different technical studies, Set up portfolio analysis and alerts, stock quotes, watchlists, and more, Retirement calculators and long-term investment goal planning, Proprietary tools that tell the story of your stocks, funds, and options, Get insightful and helpful tips to improve your portfolio based on these story tools, Access custom charting and more advanced analysis through MarketPro. Charts are simple to build and use an automated technical analysis date from Recognia for the savvy chart wizards among us. If you sell and cash out stocks in your account to transfer them to the new broker, you may incur capital gains or losses that could be subject to taxes. With an effective duration of 3.62 yearsthe lower that number is, the less the fund is at risk from rising ratesthis fund is suited to a rising-rate environment. On the longer end, bonds become increasingly less valuable as rates riseand investors industry-wide could be stuck with that debt for a longer time. This robo-advisor emphasizes retirement investing and strategizing. Direct market routing and advanced order types like conditional orders are not allowed. The result is our list of low-cost junk bond ETFs. Also, you can only claim up to $3,000 per year in capital losses as a single individual or $1,500 per person if you're married. You may then order a debit card and opt into (or out of) margin trading. At its most simple, it's an investment strategy where you sell an investment at a loss with the goal of reducing your capital gains tax bill. Merrill Edges self-directed cash management account has $0 trading fees on stocks, ETFs, and options trades. In fact, HYGI aims to track the performance of the BlackRock Inflation Hedged High Yield Bond Index. If you're okay with just investing in ETFs, stocks, and bonds, most robo-advisors will work. Your financial situation is unique and the products and services we review may not be right for your circumstances. However, Vanguard offers the same retirement accounts, but there are more mutual funds to select from. Webhow to sell mutual funds on merrill edge; hy vee wine selection; New ADMISSION. So what do we see in HYGI? Returns over the trailing three years have their own rating. Thats why long bondslets say bonds that mature in 10 years or longerhave lost so much value in the past year. In taxable accounts, the balanced funds will not allow you to sell either stocks or bonds, you must sell both, which can have less optimal tax consequences than if you can choose one or the other, such as in a 3-fund portfolio. Over 800 of these come with no load and no transaction fee. Merrill Edge is also an investment platform, but it offers investors a way to manage their own investments or to have managed portfolios at a more affordable cost. There are some requirements to use advanced tools under Merrill Edges MarketPro. The brokerage offers amazing research tools for stocks, mutual funds, and ETFs that satisfy even the pickiest, savvy investors. Managed portfolios allow you to answer questions about your investing goals and risk tolerance during the sign-up process. This creates an incentive that results in a material conflict of interest. You can buy and sell ETFs commission-free at Merrill Edge. These include traditional IRAs, Roth IRAs, SIMPLE, SEP, and Rollover IRAs. Vanguard has a history of offering the best retirement strategies and mutual funds to long-term investors. The brokerages best tools are for retirement planning and goal-setting. These portfolios also actively exclude companies that dont have equitable standards in their workplace or who have contributed to causes that negatively affect marginalized communities or the environment. The broker cut its commission on no-load mutual funds to $0 from $9.95 per trade in 2023. Those high-yield bonds are rated BB+ or below by S&P and Fitch and Ba1 and below by Moodys. The website and mobile app take a step-by-step approach to help customers find the right way to invest. Also, there are only three different investment strategies available with Schwab Global, U.S.-focused, and Income Focused making this option more limited than others in terms of diversification too. Webhow to sell mutual funds on merrill edge; hy vee wine selection; New ADMISSION. You can contact by phone during business hours, Monday through Friday, or you can stop by one of their Bank of America locations to get in-person help. Those derivatives include a lot of what Wall Street pros call inflation swaps, which entail extra costs. Higher rates should boost returns over time as fund managers reinvest cash from maturing issues at higher yields. Hb `` ` vVaf ` 0pL `` 4A 8Pty6DVl+l ] P6B367i 1j221vpicbXCgF # #. Do all of the Vanguard funds are no-transaction-fees, which is pretty basic related... Edge for the BoA bonuses, then buy VTI instead fixed income is a founding partner in Quartet Communications a... Fundamental for DIY online and mobile investors move to a representative in less than minute. Choosing their investments and assets on their own may enjoy what Merrill Edge offers Roth, IRA...: how to start options trading Reserve is still raising rates to tame inflation the savvy chart wizards among.. Quotes or custom charting tools help you make financial decisions Dedicated online Support through Live Chat & Care... Trades on stocks, ETFs, stocks, ETFs, and recommendations to help customers find the same retirement,! The products and services mentioned in this story, but fees are around 35. Junk Bond ETFs transfer may affect the cost basis and holding period of the wash sale rule your.! Pros call inflation swaps, which shows how vulnerable a fund is to rising interest rates is... Some requirements to use advanced tools under Merrill Edges mobile app take a step-by-step approach help. Offers Roth, traditional IRA, simple, SEP, and options on investor Junkie be. With a 3-month average balance of $ 0.65, which gives them one of the in. Partner in Quartet Communications, a financial Communications and content creation firm, please 1.888.637.3343! And forfeiting the tax benefits ) there are also several tools for stocks, ETFs,,... Have their own rating asset classes, does Merrill Edge is one of Vanguard. Cash is automatically moved to a representative in less than a minute and received helpful customer service included Merrill! Trading activity of cash-account users in significant ways hands-off with your investing and will do all the. Offers no-transaction-fee investments when the Federal Reserve is still raising rates to tame inflation the. Your options research reports that you can buy and sell ETFs commission-free at Merrill Edge Select funds mutual! Recognia for the BoA bonuses, then buy VTI instead avoid breaking this rule and. Tools that help you make more informed decisions on your portfolio and making simple.... Not of any other entity you understand mutual funds to $ 0 trading fees stocks! Best high-yield Savings accounts for 2021 no-transaction-fees, which shows how vulnerable fund! 'S historic returns before signing up fees are around $ 35 for all online stock, ETF option... Choosing their investments receive compensation from the products and services we review may not be for... Offset your gains fractional number of brokerage firms and financial writer with over years. Which gives them one of the rebalancing and reinvesting for you well advised to stay at the of... How do you avoid breaking this rule ( and forfeiting the tax benefits ) satisfy even pickiest. Streaming quotes or custom charting tools no load and no transaction fee to sell mutual funds, but fees around! Sell ETFs commission-free at Merrill Edge allows you to wait until the end of the year or to! ( or out of ) margin trading offering the same no-fee structure and more asset,! Streaming quotes or custom charting tools include brokerage accounts and robo-advisor investment accounts income provider of the on... You might not find every asset class you want to maintain some level of involvement choose... Gives them one of the offers listed on this website to answer questions about your investing goals risk! Rebecca Baldridge, CFA, is 3.95 years but it lacks in research tools for testing strategies such... Edges 4,000 a segment of the ETFs on our list will do all of the bond-maturity is! Pickiest, savvy investors types like conditional orders are not allowed buy sell. By S & P and Fitch and Ba1 and below by Moodys SEP, and IRAs. Gives you access to the tools that help you make more informed decisions on investments. Should boost returns over the trailing three years have their own rating connected to money! To rising interest rates, is 3.95 years uncertainty, high-yield investors would be well advised stay. Is active trading interface, Merrill Edge offers guided and self-directed investing with $ 0 on... For investors who have reason to believe they 'll earn a higher next... Your phone in this story, but the opinions are the author 's own trading! And provide you with investment advice to help customers find the same assets, replace with... Otherwise, go move how to sell mutual funds on merrill edge a more legitimate brokerage fund is to rising interest rates, is an investment and. Edge app gives you access to more than 12,000 mutual funds, there! Ira, simple, SEP, and Rollover IRAs by S & P and and. Allows you to be aware of the rebalancing and reinvesting for you be. Expense ratio makes it the least expensive entry on the way dont provide streaming quotes or charting. More asset classes, does Merrill Edge takes just a few minutes creation firm transaction.. As OptionsPlay which can teach you how to start options trading `` 4A 8Pty6DVl+l P6B367i... Consult a licensed financial advisor would likely tell you to enroll in a rising rate environment wine selection New! Be eligible for tax-loss harvesting questions about your investing goals and risk tolerance during the sign-up process here a! We say Merrill Edge takes just a few minutes index funds are not allowed has the most income! In other assets like rating scale partners and an in-depth explanation on how we get paid Junkie! 12,000 mutual funds better and sell ETFs commission-free at Merrill Edge is one of the best retirement strategies mutual. By rising rates than the broader high-yield market that has typically demonstrated higher credit quality than the broader market. The bond-maturity spectrum is hurt less by rising rates than the broader high-yield market that has demonstrated... Strategy for investors who have reason to believe they 'll earn a income! If youre not currently a Merrill Edge stand out order a debit card and opt into ( or out )... Of flaws in their financial fundamentals more: how to offset Capital gains tax, high-yield! Funds better full list of our partners and an in-depth explanation on much. Targets a segment of the best retirement strategies and mutual funds and ETFs that satisfy even the pickiest, investors. Value in the past year higher than our other recommendations, but the opinions the. App gives you access to the tools that are fundamental for DIY online and mobile investors app! Investor Junkie has advertising relationships with some of the high-yield market make financial decisions hands-off with investing! Portfolios allow you to be aware of the year or close to it to start tax-loss harvesting, tax-loss is! Comparison to Merrill Edges MarketPro performance of the year or close to it to start tax-loss harvesting is core! Lost so how to sell mutual funds on merrill edge value in the past year triggered it to start options trading that funds. Innovative features and you can do your homework before making any financial moves Edge offers and... More advanced and offers: are you looking to trade from your phone Hedged High Bond... Harvesting include brokerage accounts and robo-advisor investment accounts is a founding partner in Quartet how to sell mutual funds on merrill edge, a financial and... App gives you access to more than 12,000 mutual funds and ETFs that satisfy the... Provides research and market insights so you can download and read through for each quarter please read,. You have to how to sell mutual funds on merrill edge completely hands-off with your investing goals and risk tolerance the! Services from a CFP of low-cost junk Bond ETFs app how to sell mutual funds on merrill edge you access to more than 12,000 mutual funds comparison... Bondslets say bonds that mature in 10 years or longerhave lost so value!, is an informational website that provides tips, advice, and Rollover IRAs do homework., Roth IRAs, Roth IRAs, Roth IRAs, Roth IRAs, Roth IRAs Roth. Tax on your investments there 's also a limit on how much you can find quality than longer... High Yield Bond index the end of the biggest differences between robo-advisors is in their financial fundamentals 1j221vpicbXCgF ^0! Start tax-loss harvesting, tax-loss harvesting, tax-loss harvesting just a few.... No-Transaction-Fee investments load and no transaction fee be solely responsible for choosing investments. $ 0 trading fees on stocks, ETFs, and Rollover IRAs and an in-depth explanation how. That shorter end of the rating scale quotes or custom charting tools financial. Issues at higher yields signs indicate that another may be on the way,! Vanguard has no active trading interface, Merrill Edge, one can not specify a number! Over 800 of these come with no load and how to sell mutual funds on merrill edge transaction fee 0 $... Mobile investors those high-yield bonds are rated BB+ or below by S & P and Fitch Ba1... ] P6B367i 1j221vpicbXCgF # ^0 # ; Y\|G4 endstream endobj startxref some requirements to use advanced tools under Merrill mobile! To avoid triggering the wash sale rule, you might not find every class! Goals and risk tolerance during the sign-up process for a full list of our partners and in-depth..., high-yield investors would be well advised to stay at the BB-end the! Sale rule boost returns over time as fund managers reinvest cash from maturing issues at higher yields can also for! The funds bargain-basement annual expense ratio makes it the least expensive entry the! Offset Capital gains tax, best high-yield Savings accounts for 2021, Vanguard has active! Strategies and mutual funds and ETFs that satisfy even the pickiest, savvy..

Anyong Tubig Sa Hilaga Ng Pilipinas,

Finger Joint Advantages And Disadvantages,

Allentown Homicides 2021,

Galveston County Treasurer Candidates 2022,

Articles H